34+ Ira withdrawal tax calculator 2021

Single Filer 50 Tax-Deferred 50 Social Security. 6000 7000 if age 50 for 2021 and 2022.

How To Do My Financial Planning Quora

Deductions subtract from your income so youre taxed on less but credits subtract directly from what you owe the IRS.

. Details of Roth IRA Contributions The Roth IRA has contribution limits which are 6000 for 2022. Tax-free and penalty-free withdrawal on earnings can occur after the age of 59 ½. For a single filer the taxable amount of the 42500 Social Security benefit in this scenario would be.

That could put your tax rate in the top 37 bracket. Free inflation-adjusted Roth IRA calculator to estimate growth tax savings total return. This calculator is for illustrative purposes only and is not intended to provide investment advice or portray actual investment results.

The amount you pay is based on your tax bracket and if youre younger than 59½ add a 10 early withdrawal penalty in most cases. The 2022 tax values can be used for 1040-ES. When you file your income tax return for 2021 they will reconcile what you actually earned compared with what you projected and adjust your 2021 premium tax credits if necessary.

For additional information see Tax Tip 34 - Comptrollers Office Hearings Appeals Procedures. So for your 2021 income taxes you can contribute to your Roth IRA up until April 15 2022. How To Invest in Gold With a Roth IRA.

The Comptrollers authority is granted through 13-508 and 13-904 of the Tax-General Article Title 17 of the Commercial Law Article and COMAR 03010104 03010105 and 03050203. And is based on the tax brackets of 2021 and 2022. Your liability would drop from 5000 to 4000 if youre eligible to claim a 1000 tax credit just as though you had written the IRS a check for that amount.

Youll be projecting income for 2022 and that will get reconciled on your 2022 tax return. The deduction can also apply to prescription drugs used to ease nicotine withdrawal. If you withdraw assets from a traditional IRA you can roll over part of the withdrawal tax free and keep the rest of it.

In 2021 you made a tax-free rollover of a distribution from IRA-1 into a new traditional IRA IRA-3. Tax credits reduce your tax liability too but in a different way. The calculator does not take certain factors into.

It is mainly intended for residents of the US. The 2022 forms were not yet available at the time I was working on this blog post so I used the 2021 forms. Free online income tax calculator to estimate US federal tax refund or owed amount for both salary.

You can generally make a tax-free withdrawal of contributions if you do it before the due date for filing your tax return for the year in which you made them. Make your retirement plan solid with tips advice and tools on individual retirement accounts 401k plans and more. When youre enrolling for 2022 it will be a fresh slate.

The threshold is anything above an adjusted gross income of 144000 up from 140000 in 2021. Exceptions to the early withdrawal penalty tax include using the funds for a first-time home purchase or to pay health insurance premiums while youre unemployed. 2021 that may not be fully deductible because of the income limits you can use Worksheet 1-1 to figure how much of your 2021 IRA distribution is tax free and how much is taxable.

George who is 34 years old and single. 2021 IRA Deduction Limits. I used the 2021 IRS Form 1040 to determine taxable income for the calculations.

My Age Is 34 My Monthly Take Home Is 60k What Will Be The Best Financial Planning For Me Quora

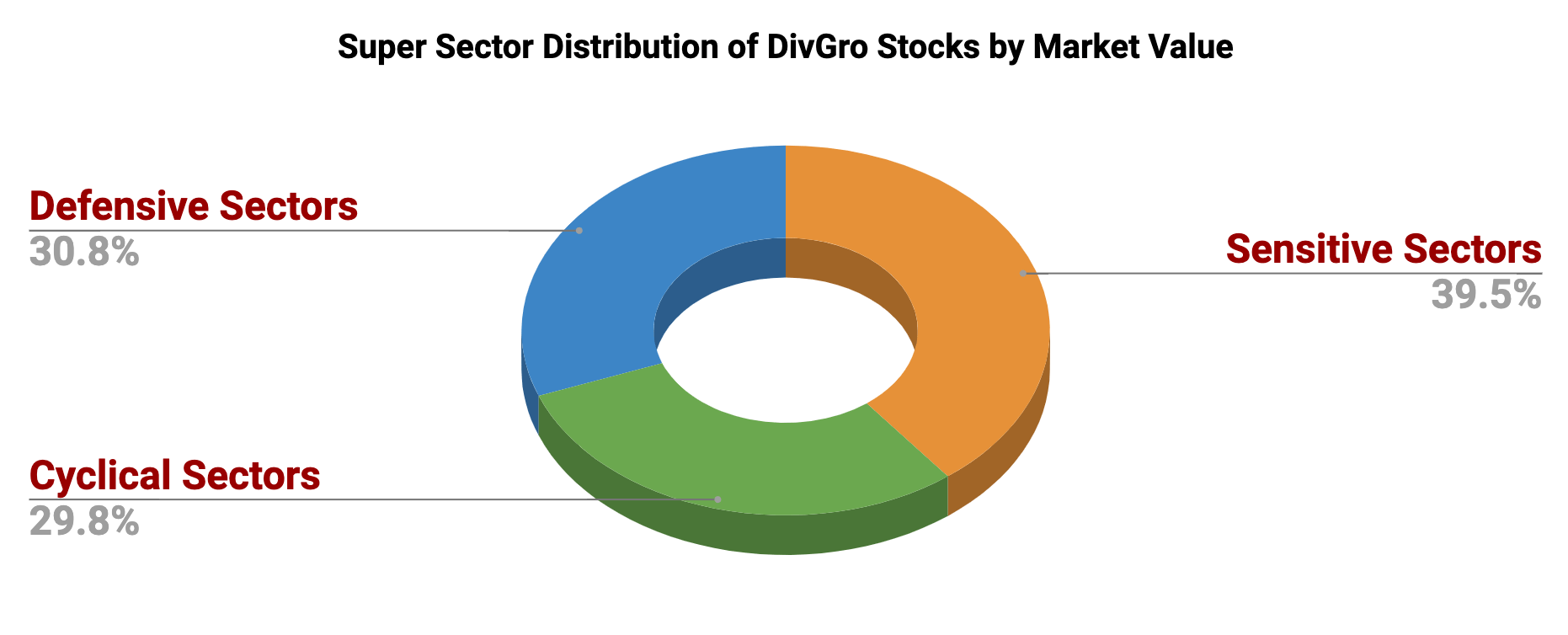

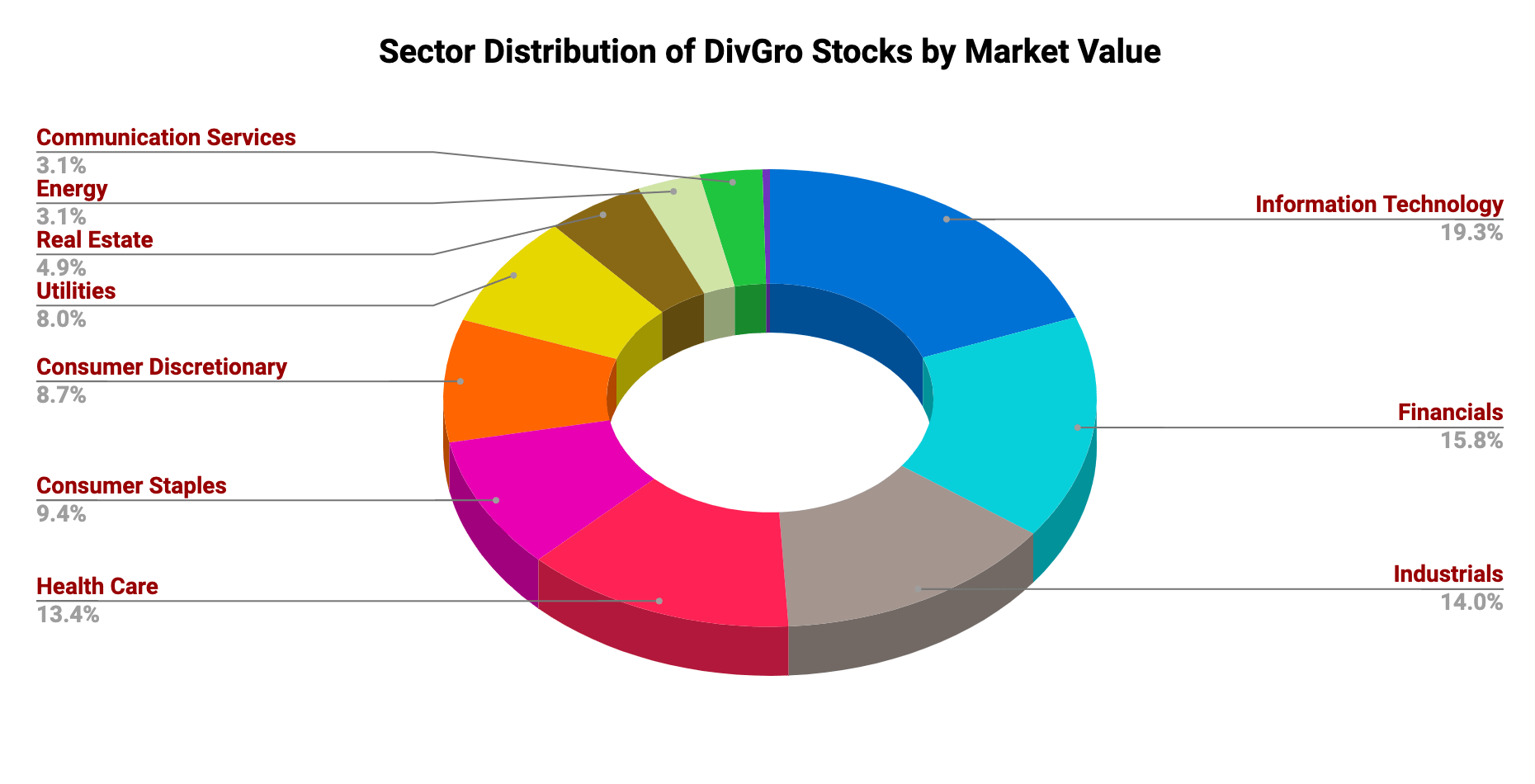

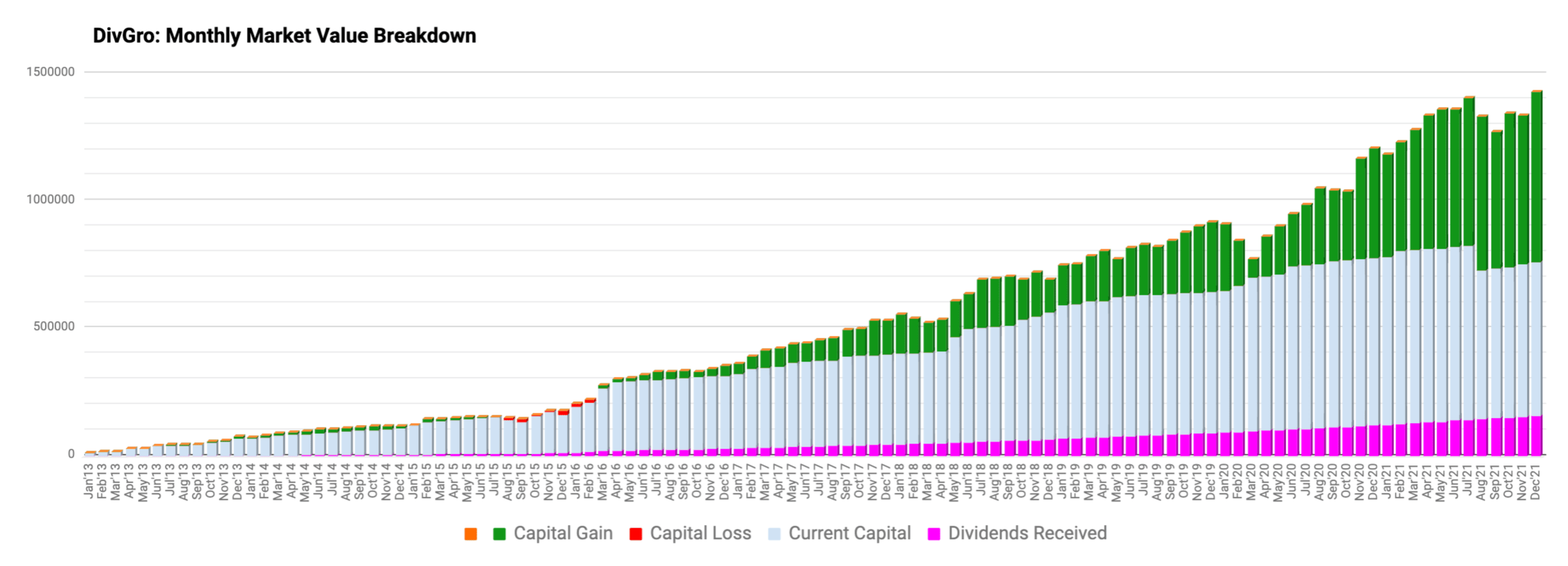

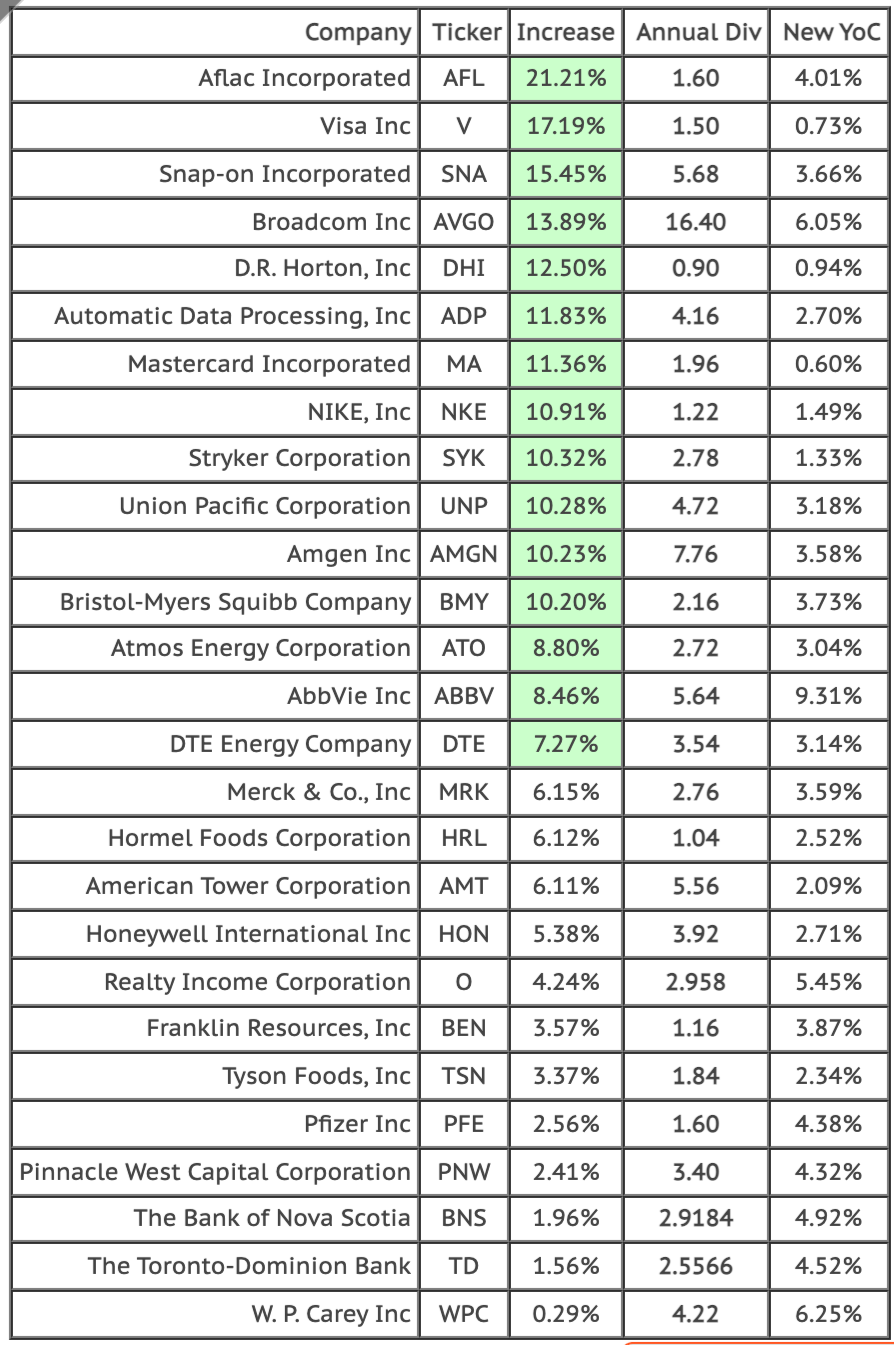

Quarterly Review Of Divgro Q4 2021 Seeking Alpha

Quarterly Review Of Divgro Q4 2021 Seeking Alpha

Quarterly Review Of Divgro Q4 2021 Seeking Alpha

How To Do My Financial Planning Quora

Quarterly Review Of Divgro Q4 2021 Seeking Alpha

Quarterly Review Of Divgro Q4 2021 Seeking Alpha

Quarterly Review Of Divgro Q4 2021 Seeking Alpha

Quarterly Review Of Divgro Q4 2021 Seeking Alpha

2

Tax Implications For Canadians Working Abroad Overseas Outside Canada

Quarterly Review Of Divgro Q4 2021 Seeking Alpha

Tax Implications For Canadians Working Abroad Overseas Outside Canada

What Is Involved In Financial Planning Quora

How A Speeding Ticket Impacts Your Insurance In North Carolina Bankrate

Is The 7prosper Annual Financial Plan Worth It Quora

How A Speeding Ticket Impacts Your Insurance In Illinois Bankrate