Fica tax withholding calculator

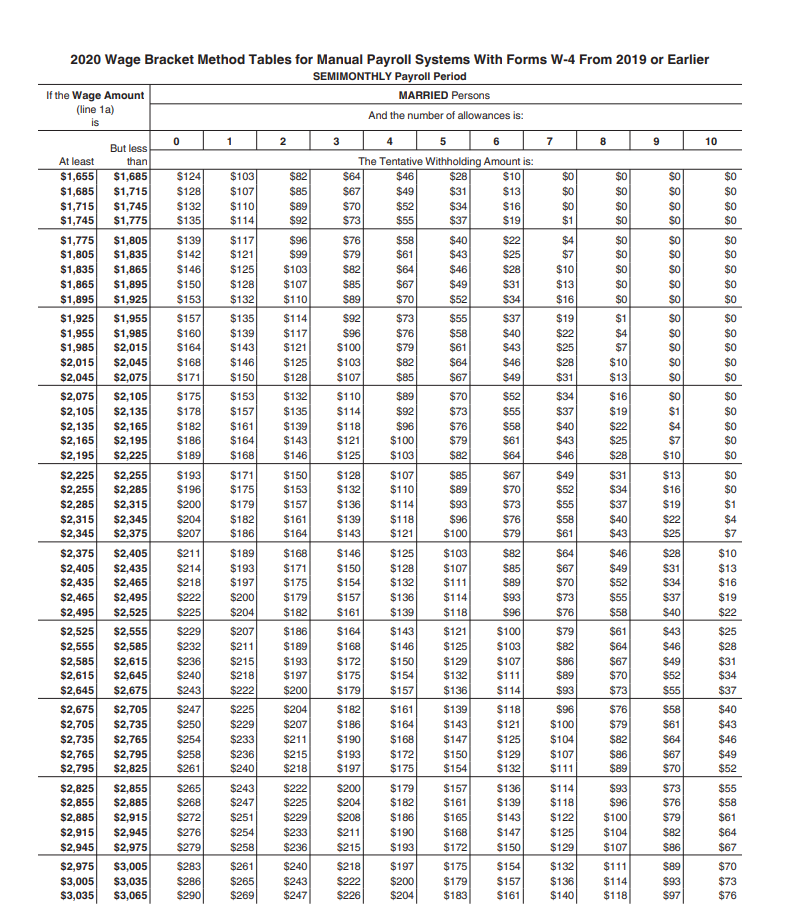

A financial advisor in New York can help you understand how taxes fit into your overall financial goals. Deduct federal income taxes which can range from 0 to 37.

Easiest 2021 Fica Tax Calculator

Financial advisors can also help with investing and financial planning - including retirement homeownership insurance and more - to make sure you are preparing for the future.

. How You Can Affect Your New York Paycheck. If you find yourself always paying a big tax bill in April. For sole proprietors or the self-employed youre required.

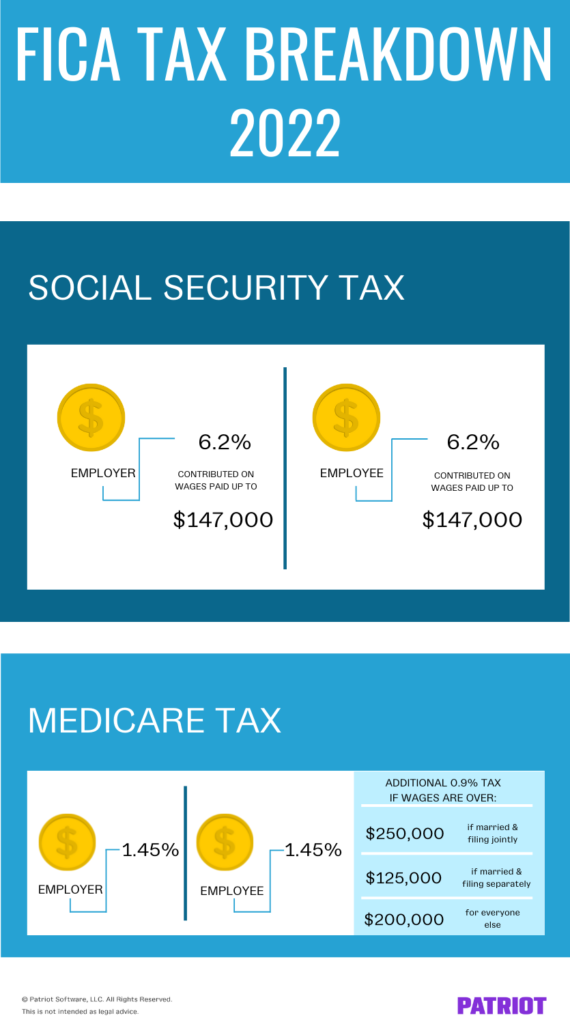

2021 FICA tax calculator is the easiest and fastest to know the social security tax and Medicare tax liability and also compute the additional medicare tax. Medicare tax rates rose from 035 in 1966 when they were first implemented to 135 in 1985. And you contribute a matching 765 for the employer portion.

200000 per calendar year for single filers or. CalculateEstimate your annual Federal tax and North Carolina tax commitments with the North Carolina tax calculator with full deductions and allowances for 2022 and previous tax years. Employers remit withholding tax on an employees behalf.

There are many benefits of using a payroll calculator including the ability to estimate your paycheck in advance. Both SECA and FICA tax rates have increased since they were introduced. For the past couple of decades however FICA tax rates have.

But if you want to know the exact formula for. Wages paid by a parent to a child are taxed. The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks.

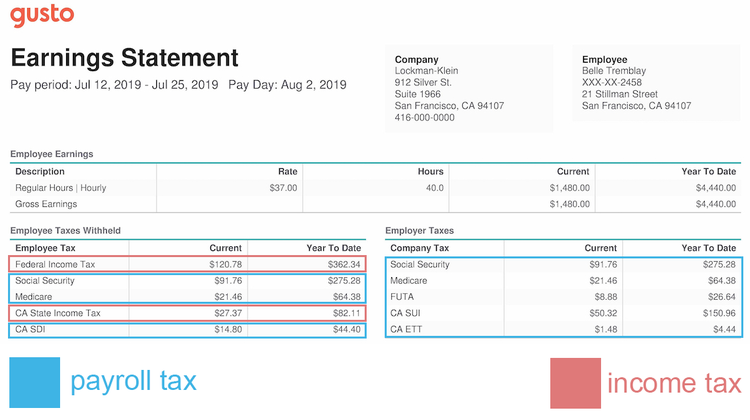

Employers withhold federal income tax from their workers pay based on current tax rates and Form W-4 Employee Withholding Certificates. FICA Exempt Income Tax State. As an employer youre required to pay FICA tax by matching your employee contributions resulting in a combined total of 153.

The AZ Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for single joint and head of household filing in AZS. You must make deposits with the IRS of the taxes withheld from employees pay for federal income taxes FICA taxes and the amounts you owe as an employer. Medicare Withholding.

The New York tax calculator is updated for the 202223 tax year. The NY Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for single joint and head of household filing in NYS. Of this FICA tax amount of 765 62 goes toward Social Security tax and 145 goes toward Medicare tax.

Dont Forget Employer Payroll Taxes. See how FICA tax works in 2022. 250000 per calendar year for joint filers.

Self-employed people pay into Social Security and Medicare through a different tax called SECA Self-Employment Contributions Act and collected via their annual federal tax returns. The US Tax Calculator is a great tool for producing detailed tax and salary calculations. Specifically after each payroll you must.

You withhold 765 of each employees wages each pay period. They pay both the employer and employee shares. FICA Tax Rates.

Federal income tax withholding. All in all the IRS receives 153 on each employees wages for FICA tax. Payments to statutory non-employees are not subject to the FICA tax.

Social Security tax rates remained under 3 for employees and employers until the end of 1959. Make calculating FICA tax online a snap try out the free online FICA tax calculator now. Your Income in detail F1040 L7-21 Wages salaries tips etc.

FICA and SECA taxes do not fund Supplemental Security Income SSI benefits. The Tax Calculator allows you to enter specific details including your filer status number of children different states your retirement funds any withholding so amounts FICA and other elements that support a more detailed tax. The Arizona income tax calculator is designed to provide a salary example with salary deductions made in Arizona.

The Ohio bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. You must also multiply wages by the 09 additional Medicare tax if your income surpasses the threshold for your tax. FICA Tax Withholding.

Wages paid by a parent to a child are not taxed if the child is younger than age 18 or age 21 for domestic workers. The calculator will use the amount entered to calculate your spouses Schedule SE self-employment tax. Take a look at the breakdown of FICA tax.

This is state-by state compliant for those states that allow the aggregate method or percent method of bonus calculations. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. FICA tax is a 62 Social Security tax and 145 Medicare tax on earnings.

Tax Information Income Tax Withholding Federal Income Tax Withholding on Wages. As employers state agencies and institutions of higher education must deduct federal income tax FIT from wages of a state officer or employeeFIT is computed based on current tax tables and on the designations and exemptions claimed by the employee on his or her W-4 form. Payments to statutory non-employees are taxable for income tax purposes.

How to calculate Federal Tax based on your Weekly Income. Withholding information can be found through the IRS Publication 15-T. The Illinois bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

Gross 401K Withholding Gross. The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. ICalculator aims to make calculating your Federal and State taxes and Medicare as simple as possible.

Lets be honest - sometimes the best fica tax calculator is the one that is easy to use and doesnt require us to even know what the fica tax formula is in the first place. Check to see if the employee has reached the additional Medicare tax level and increase deductions from the employees pay. The tax rate is 6 of the first 7000 of taxable income an employee earns annually.

How does your tax bracket impact how much FICA is withheld. Multiply the Medicare tax rate by the gross wages subject to Medicare taxes. However youll pay an additional 09 of your salary toward Medicare if you earn over.

Those are paid out of general tax. Your tax bracket doesnt necessarily affect how much money you contribute to FICA. If you are subject to additional medicare tax withholding you must file Form 8959.

The Arizona tax calculator is updated for the 202223 tax year. When completing this form employees typically need to provide their filing status and note if they are claiming any dependents work multiple jobs or have a spouse who also. If your company is required to pay into a state unemployment fund you may be eligible for a tax credit.

To calculate FICA tax simply multiply gross earnings by 765. The New York income tax calculator is designed to provide a salary example with salary deductions made in New York. Benefits of Using a Payroll Calculator.

You can also use the same tool to calculate hypothetical changes such as withholding more money from each paycheck or increasing your retirement contributions. Short-term capital gain or loss This is the total profit you realized from the sale of assets such as stocks bonds collectibles and other asserts owned less than one year. IRA and 401K Calculator.

Income Tax Withholding. This bonus tax aggregate calculator uses your last paycheck amount to apply the correct withholding rates to special wage payments such as bonuses. Again this percentage includes 62 toward Social Security and 145 toward Medicare tax.

How to Calculate FICA Tax.

Tax Withheld Calculator Shop 57 Off Www Wtashows Com

How To Calculate Taxes On Payroll Shop 57 Off Powerofdance Com

Free Weekly Payroll Tax Worksheet Payroll Taxes Payroll Template Payroll Checks

Payroll Tax Vs Income Tax What S The Difference

29 Free Payroll Templates Payroll Template Payroll Checks Payroll

Fica Tax 4 Steps To Calculating Fica Tax In 2022 Eddy

Easiest 2021 Fica Tax Calculator

What Is Fica Tax Contribution Rates Examples

Federal Income Tax Fit Payroll Tax Calculation Youtube

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp Payroll Payroll Software Savings Calculator

Calculation Of Federal Employment Taxes Payroll Services

How To Determine Your Total Income Tax Withholding Tax Rates Org

How To Calculate Payroll Taxes Methods Examples More

Calculation Of Federal Employment Taxes Payroll Services

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Tax Withholding For Pensions And Social Security Sensible Money

Paycheck Calculator Take Home Pay Calculator